The Air, Water, Energy (AWE) industry, defined broadly, is a market of nearly 1 trillion dollars. Stainless steel is used in the structure and parts in more than 15% of the applications. Stainless is selected to protect either the hardware or the product being manufactured. Various grades of stainless are selected based on corrosiveness, abrasion, pressure, and contamination. Sheets are used in ductwork, vessels, and components such as mist eliminators. More complex forms such as castings and forgings are used in mixers, dryers, pumps, valves, and compressors. High-speed decanter centrifuges use cast rotors. Some suppliers of stainless components are achieving Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) above 30%. They focus on the most profitable opportunities among the hundreds of products and thousands of variations used in dozens of industries by tens of thousands of customers.

By Robert McIlvaine, President & Founder, The McIlvaine Company

The selection of the high EBITDA targets depends on a value proposition that justifies a premium price for the stainless product. This justification depends on identifying the relevant facts and factors among the millions of choices. The Most Profitable Market (MPM) program uses the Industrial Internet of Wisdom (IIOW) to cost-effectively provide easy access to all this information.1

There are 50,000 large plants and over 1 million smaller plants buying stainless AWE products.

Few would dispute the benefits of an approach that identifies every opportunity, but many will question the ability to assemble millions of facts and factors. Simultaneously, many accept that AI will one day make this approach practical; with the Industrial Internet of Wisdom (IIOW) the benefits of AI are immediately available.

Analyzing Niches

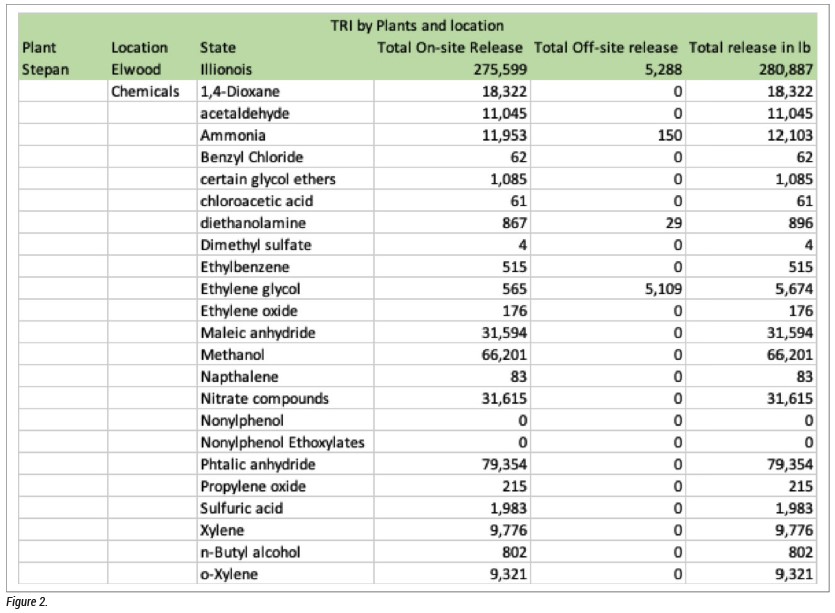

The wisdom in a particular niche can be assembled from the available data in the media, associations, institutions, and governments. There is a vast quantity of information available about stainless purchasers. Equipment leaks cause fugitive emissions. Plants in the U.S. are required to obtain air permits detailing their expected emissions. They are also required to report each year on the releases of more than 20 toxic chemicals. The selection of stainless steel is affected by the chemicals being processed. So, the emissions at each plant can be used for detailed market forecasts. Figure 2 depicts the toxic release data for one plant.

The information from government sources is supplemented by industry and general media. For example, here is a CBS article:

“Rescue crews are on the scene of a possible chemical leak at a plant in far southwest suburban Elwood. The incident occurred around 9:30 a.m. on Tuesday at Stepan Chemical Co., 22500 W Millsdale Road. According to the Will County Emergency Management Agency, a relief valve opened, and a chemical called therminol was released in vapor form.” CHICAGO (CBS)

With IIOW, intelligence from all these disparate sources can be assembled and analyzed to determine the number of stainless products and the facts and factors relevant to the selection of a specific stainless type.

Detailed information is available for countries worldwide. The data available in Europe is at least equal to that in the U.S. A surprise bonus in the Chinese data is the availability of English abstracts in many articles.

Final Thoughts

The program to forecast the purchases for each plant or by each OEM in each niche is just a supplement and reinforcement of work that is already going on throughout the organization. Each time a salesman makes a phone call, every inventory order by a purchasing person, each decision to participate in an exhibition, and each management hiring decision are all based on assumptions about the prospects. Supplementing this with an organized system provides not only guidance but fosters discourse and information exchange among personnel. This will result in continuous improvement and consensus.

The program can and should result in 40% or greater market share and 30% or greater EBITDA. The general use of AI may be years away, but the elements can be pursued niche by niche now.