Stainless Steel World Americas examines emerging trends in the stainless steel industry — in both technology and business strategy — and how steel companies are responding to these changes.

By Madilyn Miller – Editor, Stainless Steel World Americas

The stainless steel industry continues to evolve with innovative technology and production techniques, geopolitical uncertainty, and CO2 emissions regulations. It is important to understand the challenges steel companies face with these advancements, and how they address the changing landscape of the industry.

Technological Innovations

With rapid technological developments, staying aligned with cutting edge solutions is essential to enhance stainless steel production and performance.

Additive Manufacturing (AM)

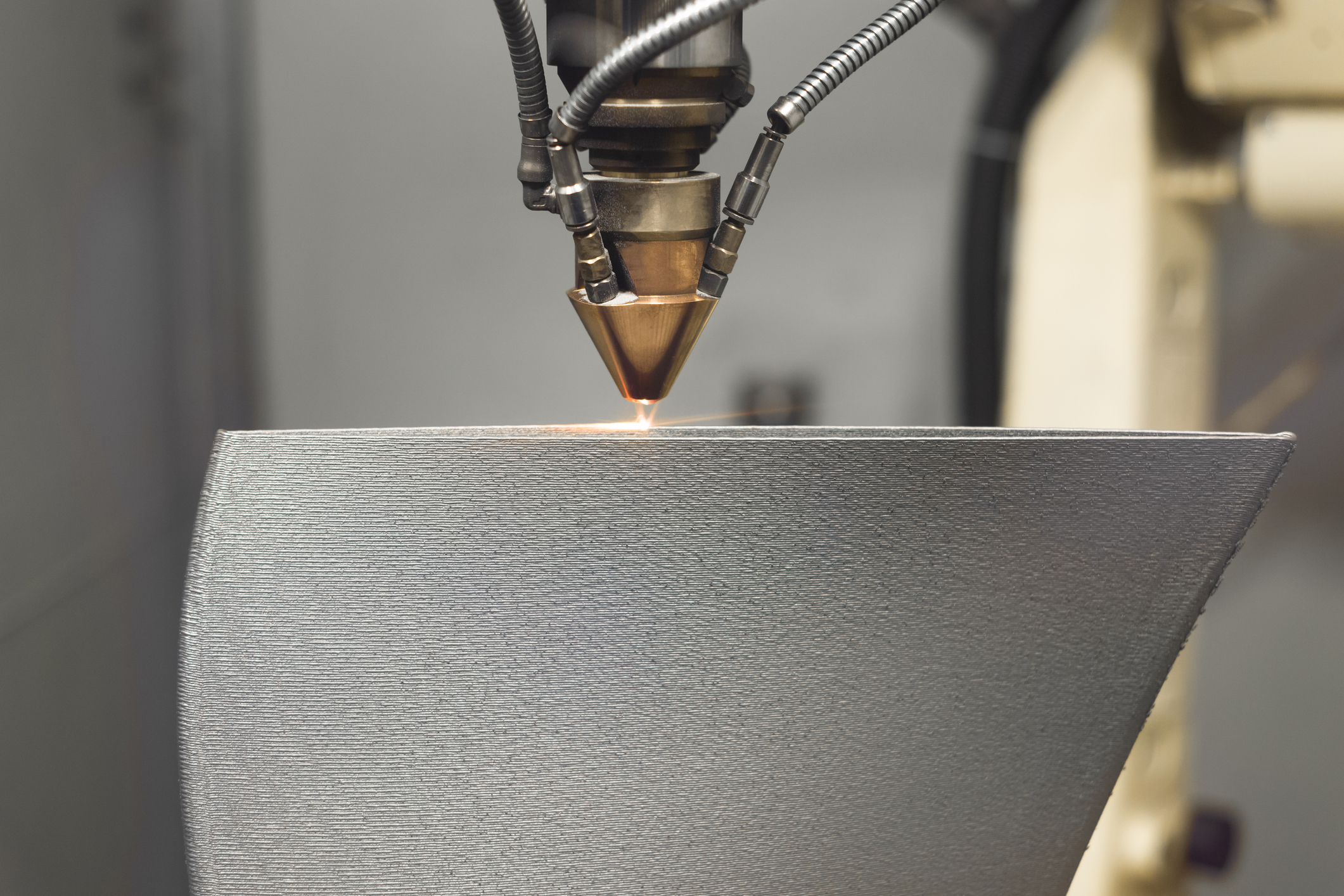

Additive Manufacturing (AM), or 3D Printing, has emerged as an effective tool for improving stainless steel production.

The Laser Metal Deposition (LMD) process — a variation of AM derived from Direct Energy Deposition (DED) technology — prints with welding wire that is melted as it is applied. This process fuses the print layers together, effectively welding the structure during production (Meltio 2024). With no additional welding required, LMD reduces manufacturing time, while improving product density and reliability.

Components not feasible for traditional manufacturing methods can be additively manufactured with improved design and material selection (Meltio 2025). AM supplies components and materials that can be difficult to source, a common challenge for sectors such as oil & gas and mining, while reducing material waste and cost.

Replacing parts that have failed or require maintenance is also done with AM. It supplies low-cost, improved components faster than alternative manufacturing methods, shortening planned and unplanned downtime (The Steel Printers n.d.).

Alloying Elements

Stainless steel alloys enhance stainless steel properties, including corrosion resistance and structural integrity. Alloys are consistently improved to ensure reliability in corrosive environments, such as chemical processing plants and offshore rigs (Lux Metal 2024). This helps extend service life and reduce maintenance of alloyed stainless steel products.

Tungsten (W), titanium (Ti), and niobium (Nb) are just some of the alloying elements added to enhance stainless steel. The presence of Nb allows carbide formations to hinder precipitation of the secondary carbide phase (M23C6). This improves high-temperature strength and hardness of stainless steel (Sharifikolouei, et al. 2022).

Nb also enhances the yield and tensile strength of stainless steel without affecting grain size, according to a study supported by the Korea Institute of Industrial Technology (Han, Song and Park 2024).

Metals and alloys (specifically nanocrystalline alloys) can also be improved with grain refinement. Fine-grained nanocrystalline metals have better strength and hardness compared to coarse-grained metals. However, they also have low thermal stability at high temperatures as well as brittleness as low temperatures. Thermal stability and brittleness are addressed with the addition of other alloying elements, like yttrium (Sharifikolouei, et al. 2022).

Nanotechnology

Alloys are not the only way to improve stainless steel. Today, nanotechnology is used to produce a nanostructured surface layer on stainless steel, offering the same properties without additional alloyed materials. This results in a lightweight, cost-effective, and reliable product (Caballero and Capdevila 2013).

Nanotechnology is also used in other sectors of the stainless steel industry, such as the use of nano-sensors during steel production to monitor quality. Microstructural defects that are missed by other quality control methods are caught by the sensors, leaving only the highest quality stainless steel by the end of production. Additionally, the sensors reduce CO2 emissions with optimized production efficiency and shorter production times (Wright 2025).

Green Steel Production

Stainless steel production technology is changing constantly to adhere to current and future CO2 emissions regulations.

Electric Arc Furnaces (EAFs) use an electric arc and recycled scrap to produce low-carbon steel. Compared to traditional blast furnaces and Basic Oxygen Furnaces (BOF) — which use extracted raw materials and fossil fuels (Nucor 2025) — EAFs are a more sustainable solution with a smaller carbon footprint.

Hydrogen-based direct reduction (HDR) is another green alternative that replaces reducing agents like natural gas in the direct reduction process.

Evolving Business Approaches

The industry has undergone significant transformations in recent years. Growing at more than twice the rate of overall crude steel production, global stainless steel production reached 62.6 million tons in 2024, a 74% increase from 2010 (Ito, et al. 2025).

This growth represents the significance of market trends for manufacturers, and highlights the importance of adopting appropriate strategies to account for evolving conditions.

The Impact of Tariffs

Outokumpu commissioned Kairos Future for a global survey of steel companies in May 2025. Out of 70 different companies — with a combined annual revenue of approximately USD $428.85 billion — 49 responses from senior decisionmakers were recorded. In response to the tariffs, the survey revealed:

- One in three organizations paused or delayed orders.

- 30% switched suppliers.

- Over half re-evaluated their sourcing strategies (Outokumpu, Kairos Future 2025).

Additionally, North American companies reacted to the tariffs faster and locked in prices over the long-term, while European companies fortified their inventory levels, circumventing further disruptions (Ibid.).

U.S.-based producers are also prioritizing high-demand stainless steel grades, such as 304, to prevent shortages. As a result, less common grades could become more expensive and less available (Bastin 2025).

The Race to Net Zero

To inform decarbonization efforts, The Greenhouse Gas (GHG) Protocol established three scopes:

- Scope 1: Direct Emissions – Emissions that are the direct result of the company and the company’s owned-and-controlled resources.

- Scope 2: Indirect Emissions – Emissions indirectly caused by a company’s/organization’s energy usage.

- Scope 3: Other Indirect Emissions – Emissions not classified under Scope 1 or Scope 2 that the company/organizations are still indirectly responsible for (Fasih 2022).

With the Scopes in mind, the metals industry employs various approaches to decarbonization, including:

- Increasing access to renewable electricity.

- Adopting circular economy approaches through steel recycling, by-product re-use, etc.

- Shifting to carbon-free reducing agents like hydrogen (Rocca 2025).

Product Carbon Footprints (PCFs) are one obstacle to decarbonizing stainless steel production, since — compared to alloyed or carbon steels — stainless steel has a higher PCF.

This is because enhancing stainless steel’s corrosion resistance and durability involves alloying metals, like chromium (Cr) and nickel (Ni), that are added as ferroalloys. Produced from ores and sulfides, ferroalloy refinement requires high-energy smelting processes often using fossil fuels, which results in increased emissions from production under Scope 3.1 (Ito, et al. 2025). Scope 3.1 is classified as upstream emissions from the production of goods purchased or acquired by a company (Walsh and Millot 2025).

Artificial Intelligence (AI)

Artificial Intelligence (AI) is revolutionizing the stainless steel industry. It is used to automate manufacturing processes and quality monitoring, as well as improve production efficiency (Samsung C&T Global PR Manager 2024). By optimizing production processes and reducing energy consumption, AI contributes to lowering CO2 emissions that occur throughout production.

However, AI has a sizeable environmental impact through the data centers used to power the systems, primarily through energy consumption, water usage, and carbon emissions. Over a 12-month period (ending August 2024), data centers were responsible for 105 million metric tons of CO2, or 2.18% of national emissions in the United States (O’Donnell 2024). With rapidly increasing adoption of AI across many industries, it is vital that steel companies account for the negative environmental impacts of AI while employing it in their processes.

Conclusion

Shifts in technology, politics, and business will neither slow down nor reverse; the industry’s continued growth requires flexibility to adapt to the transforming landscape of stainless steel.

Creative approaches to change are beneficial. Steel producers can forge their path for future success — designed around their own needs and customer base — through innovative approaches and strategies, driving future growth and setting them apart from competitors.

Finally, a strong commitment to the future of stainless steel can help guide the successful adoption of new regulations and technologies. Decarbonization necessitates this commitment, encouraging producers and end users to be conscious of their carbon footprints and environmental impacts while still pushing for the continuation of stainless steel production. Adapting to the regulations means a commitment to a healthier environment for everyone and future growth of the industry.

References

Bastin, Nichole. 2025. Stainless MMI: Tariff Impacts on the Stainless Market. June 9. Accessed November 27, 2025. https://agmetalminer.com/2025/06/09/tariffs-stainless-steel-prices/.

Caballero, Francisca G., and Carlos Capdevila. 2013. “Nanoengineering in the modern steel industry.” Materials Science and Technology 1149-1151.

Fasih, Fatima. 2022. What are Scopes 1, 2, and 3 of Carbon Emissions? April 8. Accessed December 2, 2025. https://www.safetystratus.com/blog/what-are-scopes-1-2-and-3-of-carbon-emissions/?gad_source=1&gad_campaignid=19343663681&gbraid=0AAAAADobsSW2ZbqqbBMTMsQTgUerCZdpt&gclid=EAIaIQobChMI86_6366fkQMVbitBh3QtDzREAAYASAAEgIzv_D_BwE.

Han, Soo Bin, Hyejin Song, and Sung Hyuk Park. 2024. “Improvement of tensile properties through Nb addition and heat treatment in additively manufactured 316L stainless steel using directed energy deposition.” Journal of Materials Research and Technology 4806-4821.

Iodice, M., L. Ardito, S. Lisi, G. Digregorio, and A. C. Garavelli. 2025. “Decarbonizing Steel Production: Economic and Environmental Implications of Green Hydrogen- Based Direct Reduction.” IFAC-PapersOnLine 97-102.

Ito, Akio, Michael Poetzl, Hannah Zühlke, and Robert Baron. 2025. Addressing upstream emissions in stainless steel. November 7. Accessed November 27, 2025. https://www.rolandberger.com/en/Insights/Publications/Addressing-upstream-emissions-in-stainless-steel.html.

Lux Metal. 2024. The Latest Innovations and Developments in Stainless Steel Production. July 26. Accessed November 27, 2025. https://luxmetalgroup.com/the-latest-innovations-and-developments-in-stainless-steel-production/.

Meltio. 2025. Meltio’s advanced additive manufacturing proving to be an industrial solution in different sectors with real metal printed parts. July 16. Accessed December 1, 2025. https://meltio3d.com/meltios-advanced-additive-manufacturing-proving-to-be-an-industrial-solution-in-different-sectors-with-real-metal-printed-parts/.

Meltio. 2024. The benefits of 3D printing metal parts. June 10. Accessed November 27, 2025. https://meltio3d.com/the-benefits-3d-printing-metal-parts/.

Nucor. 2025. Circularity in Steel Series: Part 2, How to Make Steel with an Electric Arc Furnace (EAF). Accessed December 1, 2025. https://nucor.com/newsroom/circularity-in-steel-series-part-2-how-to-make-steel-with-an-electric-arc.

O’Donnell, James. 2024. AI’s emissions are about to skyrocket even further. December 13. Accessed December 11, 2025. https://www.technologyreview.com/2024/12/13/1108719/ais-emissions-are-about-to-skyrocket-even-further/.

Outokumpu, Kairos Future. 2025. The Evolution of Materials: Stainless Steel Insights 2025. Research Report, Outokumpu.

Rocca, Alessandro Della. 2025. “A perspective on the decarbonization of the metals industry.” Applications in Energy and Combustion Science 21.

Samsung C&T Global PR Manager. 2024. Samsung C&T Newsroom. October 11. Accessed November 27, 2025. https://news.samsungcnt.com/en/features/trading-investment/2024-10-market-inside-amp-beyond-the-key-trends-shaping-the-future-of-the-steel-industry/.

Sharifikolouei, Elham, Baran Sarac, Alexandre Micoulet, Reinhard Mager, Moyu Watari-Alvarez, Efi Hadjixenophontos, Zaklina Burghard, Guido Schmitz, and Joachim P. Spatz. 2022. “Improvement of hardness in Ti-stabilized austenitic stainless steel.” Materials & Design.

The Steel Printers. n.d. The Steel Printers. Accessed November 27, 2025. https://www.thesteelprinters.com/news/understanding-the-impact-of-additive-manufacturing-in-the-steel-industry.

Walsh, Shelby, and Julia Millot. 2025. Scope 3.1 emissions: How to measure and reduce value chain impact. June 3. Accessed December 11, 2025. https://www.carbon-direct.com/insights/scope-3-1-emissions-how-to-measure-and-reduce-value-chain-impact.

Wright, James. 2025. Nanotechnology in Steel Manufacturing. April 11. Accessed November 27, 2025. https://www.bakersteeltrading.co.uk/steel-nanotechnology/.