In the past three years, the dash to green steel, both carbon and stainless, has accelerated. Stainless steel is intrinsically more sustainable than carbon steel because it is more durable, as well as being used extensively in green transition applications. In addition, 3D printing, recycling and electrification are helping to reduce carbon footprints still further.

By James Chater

It is an enormous challenge: how to reduce the carbon footprint of steel and stainless-steel mills? Astonishingly, producing stainless steel on average generates seven times its weight in CO2 emissions. What can be done?

The last three years have seen a marked increase in decarbonization initiatives, mostly in Europe and Asia, both in carbon-and stainless-steel mills. European stainless steel producers and fabricators such as Alleima, Aperam, Mannesmann Stainless Tubes and Outokumpu are closely examining their carbon footprint, decarbonizing their energy supply and intensifying their recycling activities. Outokumpu and Aperam have launched sustainable products with near-zero footprint and have stepped up the re-use of scrap. Europe’s most active player is Outukumpu, which has undertaken to reach zero CO2 emissions by 2050, though it aims to get there much sooner. Stefan Erdmann, Outokumpu’s Chief Technology Officer, says the company generates 0.5 kg of CO2 to make 1 kg of its Circle Green stainless steel (depending on the desired grade and alloy composition) compared with a world average of 7 kg of CO2 (data provided by the CRU Group and worldstainless, for 2023).

Sustainable Stainless

Stainless steel has a head start over carbon steel in that it is longer-lasting. This durability is important as it means less metal is consumed, and because mining and refining have a large carbon footprint. Stainless is essentially a “set and forget” material, one moreover that does not need painting. Another sustainable feature is the favourable strength-to-weight ratio of many grades, especially duplex, which means less fuel is consumed when it is applied in ships or heavy vehicles, as well as in the handling and transportation of the materials. Stainless steel plays a crucial role in the green transition, as it finds multiple applications in low- and zero-carbon energy (wind, wave, solar, geothermal, biomass, hydrogen, nuclear) and decarbonization (air-scrubbing systems in carbon capture and storage). In water applications, stainless steel’s corrosion resistance and inert character make for greater hygiene and fewer leaks, conserving both materials and water. On buildings, stainless steel’s reflective capacity allows it to deflect and dissipate heat so that less air conditioning is needed.

3D Printing

New technologies are supporting sustainability not only in primary manufacture but also in fabrication. 3D printing, which is increasingly being used to make high-alloy components in aerospace, medicine and other industries, is less energy-consuming and wastes less material than subtractive manufacturing. The materials invented specifically for 3D printing have properties that cut CO2 emissions. For instance, Sandia National Laboratories has just announced a new 3D-printed superalloy that is stronger at 800°C than others currently used in turbine parts. This translates into lower emissions for every watt of power output. Outokumpu entered the 3D-printing business a year ago by starting to produce low-carbon content metal powder at the company’s mill in Krefeld, Germany. The metal powder production further strengthens the circular economy by using steel scrap from local production.

Recycling

Stainless steel, like carbon steel, is 100% recyclable – except here too stainless has an advantage, as it rusts less quickly if at all! (However, with certain specialty CRAs such as heat-resistant nickel alloys, 100% recyclability cannot be achieved.) The most important alloying elements – chromium, molybdenum, aluminium, copper, nickel and titanium – are also recyclable. However, “at a global level almost 50% of the materials to produce stainless steel are scrap materials (stainless steels and carbon steel scrap)” (World Stainless Association CO2 Emissions Report). By contrast, Outokumpu uses 95% recycled material (nickel content excluded) and is aiming to go even further. It has also started to recycle the waste – unused slag, tailing sand from mining operations, as well as sludge, dust and scales from production. The metals from these waste streams are extracted and can be re-used in stainless steel production. The waste can also be recycled in road construction, refractory and concrete production, as well as water treatment. Other stainless steel producers boosting their recycling operations include BUTTING (which is working with Cronimet Envirotec to recycle materials, waste and cutting residue) and Stalatube, which guarantees that a minimum 75% of stainless steel raw materials are recycled. This uptick in recycling activity is driving sales of electric arc furnaces (EAFs), in which electricity replaces fossil fuels (see below).

Carbon capture and storage (CCS) is another way of dealing with CO2. The steel industry has been using it for several years, and several new projects are in the offing. In the stainless steel industry, Outokumpu is leading the way by exploring with QPower the potential of carbon capture utilization (CCU) to re-use the company’s emissions as raw materials to make new products such as e-fuels.

Decarbonization

Three promising paths towards decarbonization are electrification, biocoke and (possibly) the use of hydrogen as a reductant.

Electrification

Both carbon steel and stainless steel mills are switching from coke-fuelled blast furnaces to EAFs, which produce lower CO2 emissions than blast furnaces. They are not new, having originated in the 19th century. They are the preferred type of furnace in mini-mills, but integrated mills are turning to them as they can smelt scrap consuming less energy than traditional blast furnaces. They are also more efficient, as they can be switched on and off to accommodate fluctuations in demand. Naturally, the CO2 reduction will be greater if the electricity is renewably resourced: it is no coincidence that green-steel projects are largely concentrated in countries where most electricity comes from fossil-free sources such as renewables and nuclear. Outokumpu, being the only producer in the world to mine its own chromite, is well placed to refine it into ferrochrome in a more sustainable manner, using low-carbon electricity there as well as with its operations locally.

The ore is crushed, then, using centrifugal forces, is concentrated into chromite. The concentrate is injected into a more efficient type of EAF, the submerged arc furnace (SAF). Into this melt, carbon is added solely as a reductant, not as a heat source, along with other materials. One of the waste products of this process is carbon monoxide, which is either sold (for instance, to chemical plants) or re-used as fuels to fire up the furnaces. Some carbon-steel mills are building their own renewable power plants, including US producer EVRAZ, Panatère in Switzerland and SSAB in Italy. Among stainless-steel producers, Outukumpu is partnering with Fortum to explore the use of Small Modular Reactors (SMR) in Finland, while Aperam is exploring how to use hydro-electricity, photovoltaics, wind power and charcoal biomass from the company’s forests in Brazil. Last year India’s Jindal Stainless announced it would instal two rooftop solar plants and use wind and solar energy to power its mill in Jajpur. It has just launched a green-hydrogen electrolyzer, fuelled by solar panels, at its facility in Hisar, Haryana, India, which incorporates energy storage.

Biocoke

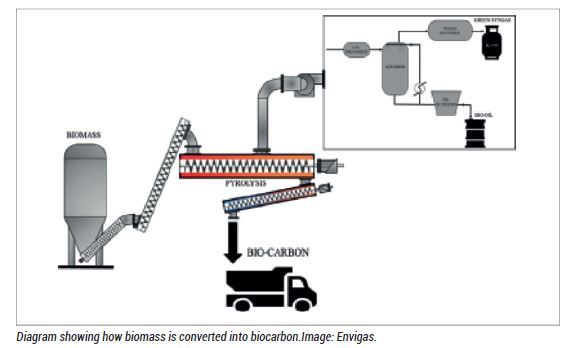

Biocoke can replace fossil coke as a reductant. Outokumpu is currently studying the implementation of a facility that converts biomass in a pyrolysis process into biocarbon which, in a second process, can be processed and pelletized into biocoke.

Hydrogen reduction

In Europe, carbon steel manufacture is being transformed by a revolutionary technology, H-DRI (hydrogen used to make direct-reduced iron), which cuts CO2 emissions by about 95%. Iron ore is reacted with hydrogen to produce DRI, which is then blended with scrap steel in an electric arc furnace (EAF) to create liquid steel. The main waste product in this process is no longer CO2 but water. Several steel makers in Europe and Asia are constructing mills that will deploy H-DRI, including SSAB, H2 Green Steel, Salzgitter, Metso, POSCO, Nippon and LKAB. However, the extent of future market penetration is uncertain: DRI manufacture is expensive and heavily dependent on subsidies. In fact, many of these producers continue to use natural gas as well as the more expensive hydrogen.

Can hydrogen be applied in a similar process to make stainless steel? Using hydrogen as a reductant can cut emissions, but because of various practical problems this method has been discussed over several decades without yet being applied. Stefan Erdmann of Outokumpu doubts if it is feasible; instead, the company is working on a new process to achieve chromite reduction. Some success has been achieved in the laboratory and the technology – still a closely guarded secret – awaits scaling up.

The Future

Decarbonization in the carbon- and stainless-steel industries is likely to take a long time and will be costly. But Stefan Erdmann of Outokumpu is confident of ultimate success. “The stainless-steel industry,” he reflects, “has reached a stage where we have to show ingenuity and question everything we think we know.” Given the challenges, it is essential to win hearts and minds. Erdmann thinks the best way to achieve this is through education. Outokumpu and Stalatube both supply documentation detailing the carbon footprint of their products, to support and inform customer in their product choices in respect to sustainability. EU legislation will go further: a law that is expected to pass soon will oblige European companies, from 2029, to prove they are taking action to protect the environment and human rights throughout their supply chain. This will have a significant impact on all steel production.

The author’s thanks to Stefan Erdmann,Chief Technology Officer of Outokumpu, for his kind help in the preparation of this article.