An analysis of thousands of acquisitions over the last 30 years shows that the stainless steel market is built on the niche achievements of several small companies who were acquired by publicly traded companies or private equity firms. The many benefits of mergers have recently increased due to the advent of IIoT and remote O&M which allow suppliers to provide solutions and not just products.

By Robert McIlvaine, President & Founder, The McIlvaine Company

There are several motivations that can cause a stainless steel company to seek acquisitions. Purchasers as well as suppliers of stainless products in the air, water, and energy markets are making acquisitions based on four main drivers.

- Expand product range

- Add complimentary products

- Expand markets

- Reduce costs

For example, one can look at the benefit for a stainless company to acquire a company with complimentary products. Typically, stainless fabrications, forgings, and castings are widely used in valves, pumps, and process equipment. To some extent, remote monitoring is needed for leak detection and other aspects of stainless performance. Of more importance is the fact that solutions providers are a new group of customers. They are more likely to use a higher grade stainless if they can validate a lower total cost of ownership through digital intelligence.

Total Solutions Market

The total solutions market for stainless steel products in air, water, and energy can be defined in different ways. One is a pragmatic approach based on the capabilities and interests of a group of OEM stainless customers. This approach excludes most discrete and mobile applications. The reason for this exclusion is that a different group of suppliers typically pursue this high volume, but small, product market. Most residential and commercial markets are also excluded. Each of the market niches in a pragmatic approach are defined in one umbrella market report.

Stainless steel products generate USD $20 billion in revenues in this Solutions Market.2 Dryers, kilns, and furnaces are not included in the total, even though stainless products used with them are. If they were to be included, the stainless percentage of the market drops from 2.6% to 1.9%. In general, stainless products represent about 0.2% of the total installed cost of process systems. These percentages are all based on the price paid by the OEM. Simply put, the price paid by the pump company for a pump casing would be included and not the sales price of the stainless steel pump.

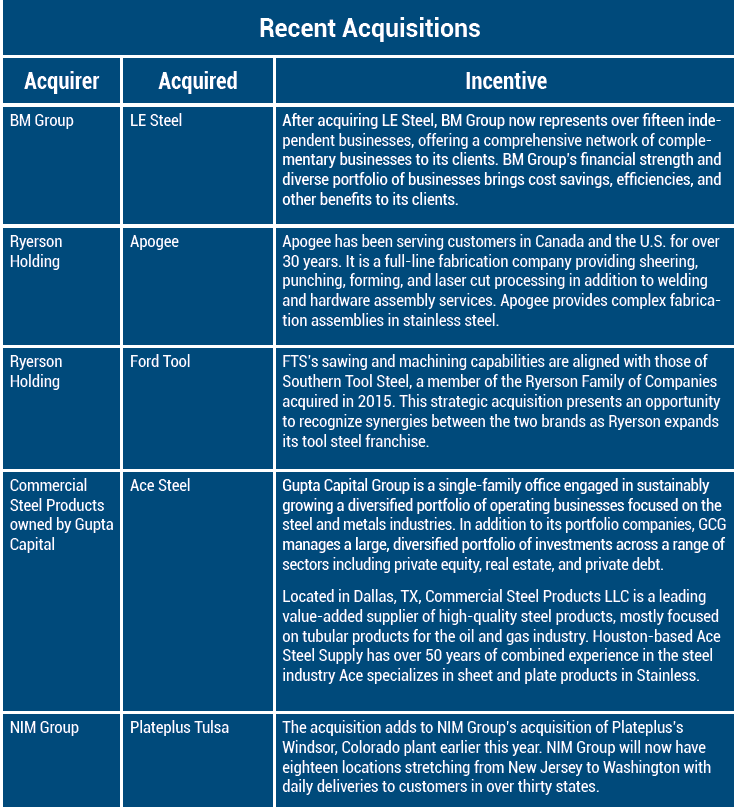

An analysis has been undertaken to determine the incentives for recent stainless acquisitions, see Figure 3.

Further Considerations

There are a few alternative options for stainless companies looking to transition to the total solutions market. One option for mid-sized stainless manufacturers is to be acquired by a larger company. Another option is to become part of a private equity portfolio which has complementary solution products. A third option is to expand one market niche at a time.

With the international political situation as well as the advent of IIoT and Remote O&M stainless suppliers will need to continually assess the opportunities and make critical decisions on a timely basis.

References

1. Air/Gas/Water/Fluid Treatment and Control: World Market published by the McIlvaine Company

2. AWE Stainless Markets published by the McIlvaine Company